China has unleashed a bold counter attack in its trade standoff with the United States, China retaliates by slapping a 34% tariff on all American goods starting April 10, 2025. This move is a direct retaliation to President Donald Trump’s recent tariffs on Chinese imports, intensifying a trade war that threatens to ripple across the global economy. Alongside the tariffs, China has rolled out export restrictions on rare earth elements and tightened trade limits on several US companies, amplifying fears of economic disruption worldwide.

China’s Bold Retaliation Measures

On April 4, 2025, China’s Ministry of Finance dropped a bombshell: a 34% tariff on every US import, matching the exact rate Trump levied on Chinese goods days earlier. This sweeping tariff will hit everything from American farm products to industrial goods, signaling China’s shift to a more aggressive stance in this escalating trade dispute.

But tariffs are just the beginning. China has also clamped down on exports of rare earth elements—vital materials like samarium, dysprosium, and yttrium that power tech innovations such as electric vehicle batteries and computer chips. With China controlling much of the global supply, this restriction could deal a heavy blow to US technology and defense sectors.

Adding to the pressure, China has targeted specific American firms. Sixteen companies now face export bans, while eleven others, including drone makers Skydio Inc and BRINC Drones, have been labeled “unreliable entities,” effectively freezing their trade with China. Beijing claims these firms are tied to arms deals with Taiwan, justifying the crackdown as a national security measure.

Trump’s Tariff Trigger

The spark for China’s retaliation came on April 3, 2025, when Trump unveiled a fresh wave of tariffs aimed at multiple nations, with China taking the hardest hit. Speaking from the White House, he announced a 34% tariff on Chinese goods—stacked on top of an existing 20% rate—pushing the total to a steep 54%. Trump framed this as a necessary counter to what he calls decades of unfair trade practices, accusing China of imposing barriers like currency manipulation.

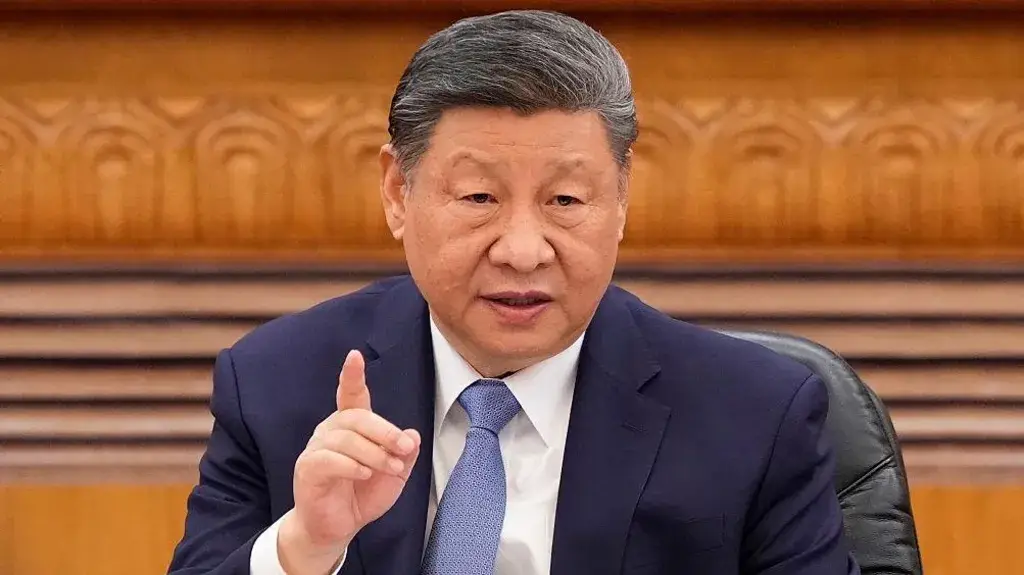

Wielding a chart of alleged trade imbalances, Trump argued that American taxpayers have been cheated for too long. He pitched his tariffs as a way to level the playing field and revive US industries, even as he nodded to his respect for China’s leader, Xi Jinping, while vowing to keep up the fight.

Economic Fallout and Market Chaos

The tit-for-tat tariffs have jolted global markets. US stock futures tanked after China’s announcement, with Europe and Asia following suit. Japan’s markets took a particularly brutal hit, prompting its prime minister to call the situation a “national crisis.” Analysts now warn of a looming global recession, with some pegging the odds at 60% by year’s end.

This trade war isn’t just numbers—it’s a high-stakes gamble with real-world consequences. Last year, the US imported nearly $439 billion in goods from China while exporting $143.5 billion the other way. With tariffs now soaring past 50% on both sides, supply chains could buckle, prices could spike, and economic growth could stall worldwide.

Expert Takes on the Trump Trade War

Experts see China’s retaliatory tariffs as a calculated power play. Some argue it’s a push to force Trump into talks, with potential concessions—like the fate of TikTok’s US operations—on the table. Others view it as a broader effort to flex China’s economic muscle and counter what they call a US strategy to contain Beijing’s influence.

Analysts note that this clash builds on months of friction, with Trump piling on tariffs since early 2025 and China initially responding with lighter measures. This latest escalation suggests Beijing is done holding back, setting the stage for a prolonged standoff that could reshape global trade.

China’s retaliatory tariffs mark a pivotal moment in its trade war with the US. With both sides digging in, the fallout is already shaking markets and raising tough questions about the future of international commerce. As businesses and consumers brace for the impact, the world watches to see if diplomacy can tame this economic wildfire—or if it’s only just begun.